Content

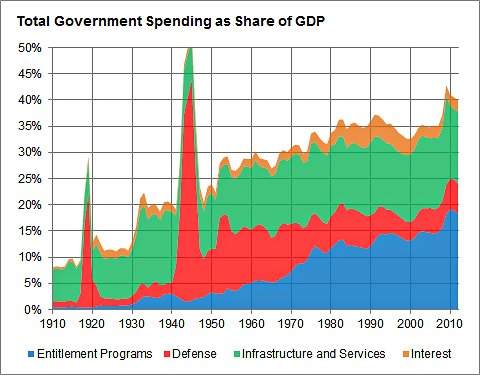

There are a few reasons why business owners might undercost their products or services. Sometimes, they may be trying to attract customers by offering lower prices. Undercosting can be a deliberate pricing strategy for some businesses, particularly new businesses. The logic is that by underpricing their products or services, they will be able to attract more customers and grow their business quickly. Finally, factor in overhead expenses such as rent and utilities. You can accurately determine your product’s cost by considering all three components.

Rent can be incorporated into the product price several ways. If it’s for a facility that manufactures or sells some products but not others, segmenting the costs among the products that the facility makes gives a more accurate estimation. Here are more examples of manufacturing overhead costs. Because product and period costs directly impact your financial statements, you need to properly categorize and record these costs in order to ensure accurate financial statements. Accurately calculating product costs also assists with more in-depth analysis, such as per-unit cost. Per-unit cost is calculated by dividing your costs by the number of units produced.

Incorporating Rent

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them. Stay updated on the latest products and services anytime, anywhere. Period costs are usually fixed but they can sometimes be variable. All businesses, whether they acquire/produce goods or not, will incur period expenses for as long as they operate.

All of the following are considered a product cost except _____. Calculate the expected cost for Depreciation when production is 5,000 units. Calculate the expected cost for Property Taxes when production is 5,000 units. Costs incurred to obtain customer orders and provide customers with a finished product. The cost of materials necessary to manufacture a product that are not easily traced to the product or not worth tracing to the product.

How To Recognize When You’re Overcosting Or Undercosting Your Products Or Services?

If you’re constantly having to perform these accounting maneuvers to avoid being overpriced, it may be time to allocate your resources toward more lucrative offerings instead. Product cost comprises of all the manufacturing and production costs, but Period Cost considers all the non-manufacturing is rent a product cost costs like marketing, selling, and distribution, etc. Based on the association with the product, cost can be classified as product cost and period cost. Product Cost is the cost that is attributable to the product, i.e. the cost which is traceable to the product and is a part of inventory values.

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. We have not reviewed all available products or offers. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The Structured Query Language comprises several different data types that allow it to store different types of information… Is generally recorded in the books of accounts with inventory assets.

What is Product Cost?

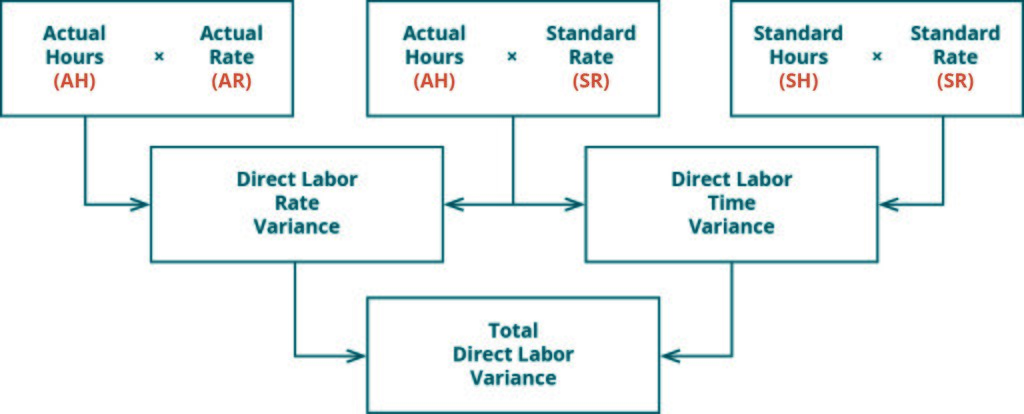

Product costs are any costs incurred in the manufacture of a product. These costs include direct materials, direct labor, and factory overhead. Variable manufacturing overhead costs are treated as period costs under both absorption and variable costing.

- There is no right or wrong answer, but businesses must know the risks involved in either pricing strategy.

- Production costs are at the core of every business, impacting its selection of suppliers and the type of products and prices it offers to customers.

- Other examples of period costs include marketing expenses, rent , office depreciation, and indirect labor.

- Such expenses cannot be capitalized into assets and occur over a duration of time.

- The cost of revenue is the total cost of manufacturing and delivering a product or service and is found in a company’s income statement.